The legislator in the Act of 1 March 2018 on Counteracting Money Laundering and Terrorist Financing, Polish Journal of Laws of 2020, item 971) (hereinafter referred to as: “the Act on Counteracting Money Laundering”) introduced the institution of the Central Register of Beneficial Owners (hereinafter referred to as: “CRBO”) and obliged commercial law companies and partnerships to report information on their beneficial owners. The deadline for submitting to CRBO, for companies and partnerships registered in the National Court Register before October 13, 2019, expires on July 13, 2020. Failure to submit by the deadline may result in a financial penalty of up to PLN 1,000,000.

Beneficial owners

Beneficial owner is a natural person or natural persons controlling directly or indirectly a company or a partnership through their rights that arise from legal or factual circumstances and enable them to exert decisive influence on the actions or activities undertaken by the company or the partnership, or a natural person or natural persons on whose behalf a business relationship is established or an occasional transaction is conducted. A detailed definition of the beneficial owner contains art. 2 section 2 point 1 of the Act on Counteracting Money Laundering.

Central Register of Beneficial Owners (CRBO)

Central Register of Beneficial Owners (CRBO) is an ICT system kept by the Minister of Finance at crbr.podatki.gov.pl, in which information on beneficial owners is processed. Via the website of the Minister of Finance, you can submit notifications to the CRBO, as well as obtain information about entities entered into the register (CRBO is public).

Entities obliged to submit a notification

In accordance with art. 58 of the Act on Counteracting Money Laundering the entities obliged to report information on beneficial owners and to update such information are general partnerships, limited partnerships, limited joint-stock partnerships, limited liability companies as well as joint-stock companies (except for public companies indicated in this article).

Information to be reported

Based on art. 59 of the Act on Counteracting Money Laundering information that shall be reported shall include: identification data of the companies and partnerships, i.e. the name (business name), the organizational form, the registered office, the Polish National Court Register number, Polish tax identification number (NIP); identification data of the beneficial owner and a member of a body or a partner authorized to represent the companies and partnerships, i.e. the first and last name, the citizenship, the country of residence, the Polish PESEL number or the date of birth-in the case of persons not having a PESEL number, information on the size and nature of the participation or on the rights of the beneficial owner.

Notification deadline

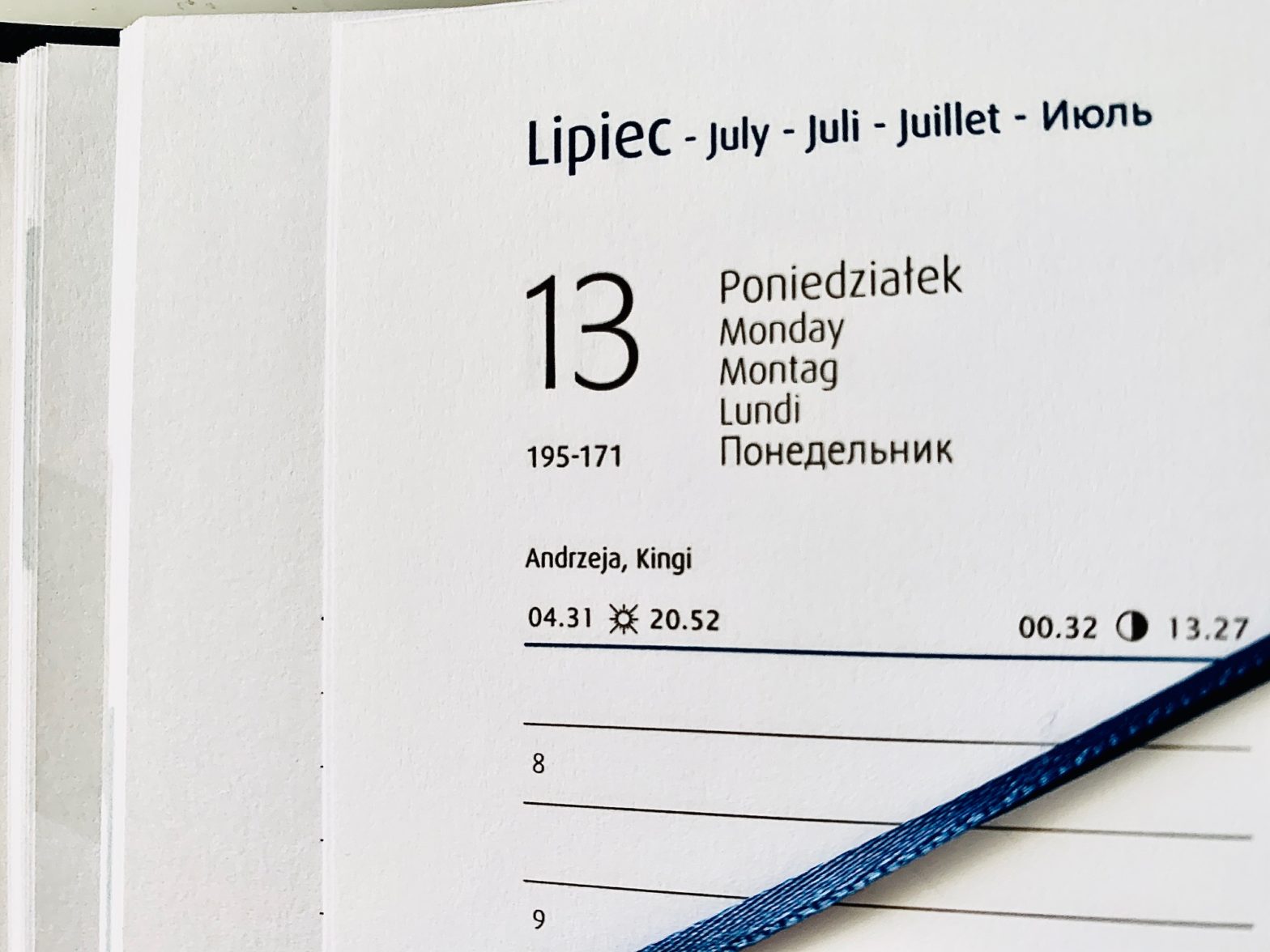

In the case of companies and partnerships that were entered into the National Court Register before the entry into force of Chapter 6 of the Act on Counteracting Money Laundering, i.e. before October 13, 2019, the deadline for notification results from art. 195 of the Act on Counteracting Money Laundering. Initially, the deadline was set at six months from the date of entry into force of Chapter 6, i.e. till April 13, 2020. As a result of the entry into force of Art. 52 of the Act of 31 March 2020 on amending the act on special solutions related to the prevention, counteracting and combating of COVID-19, other infectious diseases and crisis situations caused by them, as well as some other acts (Polish Journal of Laws of 2020, item 568), the deadline was extended to 9 months, and therefore expires on July 13, 2020.

It should be noted that the deadline of July 13, 2020 applies only to companies and partnerships that were registered in the National Court Register before October 13, 2019. In the case of companies and partnerships whose registration took place after this date, applications to CRBO should be submitted within 7 days of the day of entering the company or the partnership into the National Court Register. Also, all kinds of changes to information provided to CRBO, regardless of the date of registration of the company or the partnership in the National Court Register, should be reported to CRBO within 7 days from the date of the change.

Application to CRBO

Applications to CRBO should be made online via the website of the Minister of Finance, i.e. crbr.podatki.gov.pl, by selecting the “Create Application” field. In the first step enter the company’s or the partnership’s NIP number and choose the organizational form (from the available list). Then select the form of notification, i.e. in the case of the first notification of a company or a partnership to CRBO, enter the current date and select “Create a new notification”. The third step is to complete the form. In part A, complete the company’s or the partnership’s data, in part B enter the data of all actual beneficiaries as well as information on the beneficiary’s shares or rights / information on representation, and in part C select the liability clause. The last, fourth step is signing the form. The notification should be provided with a qualified electronic signature or a signature confirmed with the ePUAP trusted profile (Article 61 section 4 of the Act on Counteracting Money Laundering).

The notification should be made by a person authorized to represent the company or the partnership. It can therefore be a member of the management board as well as a commercial proxy (prokurent). The application cannot be signed by an ordinary proxy (pełnomocnik). In the case of joint representation, the application should be signed by all required persons, the order of signatures is irrelevant.

Application to CRBO is free of charges.

Liability for failure to submit a notification

On the basis of art. 153 section 1 of the Act on Counteracting Money Laundering companies and partnerships that have failed to comply with the obligation to report the information to CRBO shall be subject to a financial penalty of up to PLN 1,000,000. Furthermore, the company’s or partnership’s representatives are liable for damages for failing to report within the deadline or for providing false data, as well as for submitting a false statement about the accuracy of the information contained is the notification.

If you would like to obtain legal assistance in the scope of compliance by companies or partnerships with obligations related to the introduction of CRBO or other issues in the field of legal regulation concerning companies and partnerships, please contact us via the Contact Form.